Does the £15m fine imposed following a 10-year investigation into Alstom Network UK’s dishonestly won 79.9m Euro contract really incentivise companies to play safe and pursue a Deferred Prosecution Agreement (DPA)?

DPAs – Purpose and Benefits

DPAs were introduced in 2014, and can be used for fraud, bribery and other economic crime. They allow the SFO or CPS to enter into an agreement with an organisation - under the supervision of a judge - to suspend a prosecution for a defined period, provided said organisation meets the specified conditions. In order to enter a DPA, the prosecutor must satisfy both evidential and public interest tests of the code for prosecutors, which would normally lead to a full prosecution.

According to the SFO, the main advantages of a DPA are:

- They enable a corporate body to make full reparation for criminal behaviour without the collateral damage of a conviction -for example sanctions or reputational damage that could put the company out of business and destroy the jobs and investments of innocent people

- They can have no effect unless they are concluded under the supervision of a judge, who must be convinced that the DPA is in the interests of justice and that the terms are fair, reasonable and proportionate

- They avoid lengthy and costly trials

- They are transparent, public events. A DPA is not a private plea deal or bargain between the prosecutor and the company.

Though the SFO is keen to promote the benefits of a DPA, it will only invite a company to commence DPA negotiations where there has been full cooperation with its investigations. Should negotiations proceed, the company will have to agree to a number of terms, such as paying fines or compensation and cooperating with the future prosecution of any associated individuals. If the conditions are not honoured, the prosecution may resume.

Companies will therefore have to consider at an early stage whether they wish to offer such cooperation in the hope of securing a DPA and avoiding risk of conviction. The decision must take account of the possible disadvantages of a DPA.

DPAs - Disadvantages

A DPA can be extremely demanding as the court can impose enforceable undertakings, which would not be the case on conviction following trial. Companies who accept a DPA may therefore be subject to more scrutiny of their corporate governance than those who do not cooperate.

The most serious concern for any company entering a DPA is the continued threat of the SFO. According to Ben Morgan, formerly the SFO’s joint head of bribery and corruption: “if you don’t tell us, or you do and don’t engage with us properly, prosecution is a likely outcome.” A DPA is no guarantee that a prosecution will not proceed if the terms of the DPA are not complied with.

Disclosure of privileged material can also be problematic. Whilst a company cannot be compelled to waive privilege, it might decide to do so, and disclose material it would not otherwise have to, as part of demonstrating full cooperation; but should a prosecution follow, for whatever reason, the company’s ability then to restrict the use and further disclosure of such material will be very limited.

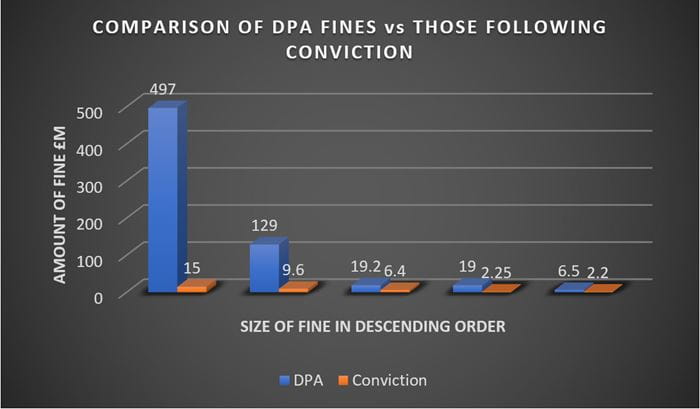

The apparent financial disadvantages of a DPA also bear scrutiny in any consideration process undertaken by a company.

Fines imposed 1

According to Alun Milford, former general counsel at the SFO the financial penalty for a DPA should be: “broadly comparable with the fine a court would have imposed if the company had pleaded guilty on a full prosecution, disgorgement of profits, payment of compensation and the SFO’s costs, enforceable undertakings of co-operation and schemes for ensuring future compliance.”

The reality, based on the limited data available, seems to be very different.

DPA fines

| Company | Year | Value (£m) |

| Standard Bank | 2015 | 25 (USD) |

| Sarclad (XYZ) Limited | 2016 | 6.5 |

| Rolls Royce | 2017 | 497 |

| Tesco Plc | 2017 | 129 |

| Serco Geografix Limited | 2017 | 19.2 |

Fines following conviction

| Company | Year | Value (£m) |

| Innospec Ltd | 2010 | 12.7 (USD) |

| Alstom Power Ltd | 2016 | 6.4 |

| Smith and Ouzman Ltd | 2016 | 2.2 |

| Sweett Group Plc | 2016 | 2.25 |

| Alstom Network UK Ltd | 2019 | 15 |

There is also the matter of prosecution costs, and those awarded on conviction often pale into insignificance next to the to the vast potential costs incurred in the full internal investigation and self-report to the SFO required by a DPA.

Though the quantity of data is limited, and no account has been taken of the specific circumstances of each case, it appears from the above figures that the fines imposed under a DPA are significantly larger than those awarded following conviction. The disparity is so great that companies will have to carefully consider whether the obvious attraction of limiting the risk of conviction is really worth the likely increased financial penalty.

Conclusion

It seems clear that the SFO is going to continue to promote the use of DPAs to companies as a lower risk option. Though the fine imposed under a DPA purports to be broadly equal to that following conviction, it would appear the price to be paid by companies seeking to avoid the risk of conviction is high. The lengthy, and comparatively inexpensive, Alstom Network conviction may well lead companies to conclude that it is worth taking the risk of putting the SFO to proof.

We advise any company which suspects that fraud, bribery or other economic crime has occurred in the course of its business dealings to take legal advice straight away, to help mitigate the potentially catastrophic consequences of an SFO investigation.

1 Figures taken from SFO website

Disclaimer

This information is for general information purposes only and does not constitute legal advice. It is recommended that specific professional advice is sought before acting on any of the information given. Please contact us for specific advice on your circumstances. © Shoosmiths LLP 2025.